Why Zurich fails the stars

The rocky Zurich Film Festival, an anti-European alliance and unhealthy numbers

Dear Insider,

Zurich should be a city of stars.

World-class infrastructure, loads of luxury brands and 5-star hospitality - not to mention a reputation for attracting the world’s very wealthiest - there is no reason to think that Switzerland’s largest city should not be loved by the famous…as well as the rich.

But while this week’s Zurich Film Festival will host the likes of Kate Winslet, Jude Law and Pamela Anderson - the city is not a magnet for the biggest names in film.

Is it the lack of nightlife? Is it the attitude of locals?

Or is it perhaps an enduring “don’t-shout-too-loud” sentiment that prevents the biggest names from feeling at home in Zurich?

In this week’s edition of The Swiss Insider, we take a closer look at the Zurich Film Festival as a business…

…plus the “terrible trio” of billionaires fighting the upcoming EU-Swiss framework agreement.

Enjoy!

Ian

💡PS: Get more timely updates and insights on LinkedIn and on X.

📽 Lights, camera...business

The show - which started so well - must go on.

In 2005, Karl Spoerri and Nadja Schildknecht kicked off the ZFF with the very first edition. The two co-founders would go on to lead the Festival for 15 years - before selling a majority stake to leading Swiss daily NZZ in 2016.

Over the course of their 10 year leadership, the festival grew significantly, with attendees increasing more than 10x.

Its budget has also grown significantly - reaching over 8 million CHF in 2024.

Where does the money come from?

A substantial part comes from government sources - the Federal Office of Culture, the City of Zurich and others. In total, approximately 15% is financed out of public funds.

And then there are the sponsorships.

The most sizeable (and therefore visible) sponsor was Credit Suisse. The big bank was involved since the festival’s first days and by 2015 had increased its contribution to over half a million Swiss francs.

Therein lies a story…

ZFF co-founder Nadia Schildknect “just happened” to be the partner of Credit Suisse Chairman Urs Rohner.

Now that the big bank founded by Swiss pioneer Alfred Escher is no more, its “big brother” has taken over the top spot, along with Mercedes. But other sponsors have been less loyal. Italian insurance giant Generali declined to renew its support.

No other financial institution has taken Generali’s place.

ZFF owner NZZ is said to be cutting corners for this year’s 20th edition of the film festival. It will likely need to do so, even after acquiring a new location - Frame Theatre on Europaallee - to host festival events.

Meanwhile, the stars (and fans) will come…and then go…leaving Zurich with only a touch of the stardust that graces more elegant and welcoming film festival host cities like Cannes, Venice or even Lugano.

The Insider Advantage:

💡It makes sense for a city of Zurich’s size and status to host a major cultural event - but the event was clearly conceived and supported as a business development venture for one company - Credit Suisse.

💡 The festival’s sale to NZZ Group inspires no little irony, given the newspaper’s decidedly free-market, liberal tilt. Meanwhile, it now owns a culturally left-leaning event series in a city that is more and more socialist with every passing year.

💡 The festival as a means of networking and connecting the wealthy and their wealth managers has only had limited success. Switzerland’s reputation remains somewhat stodgy, albeit effective - but not very flashy.

🇪🇺🇨🇭 The heavyweights hitting out at EU deal

The big boys don’t want it.

Three Swiss billionaires, Alfred Gantner, Urs Wietlisbach, and Marcel Erni, have launched the "Kompass Europa" initiative to oppose the impending ratification of the Swiss-EU Framework Agreement.

They argue that the deal subjects small Swiss businesses to burdensome EU regulations and will outweigh any economic benefits from access to the single market.

The irony in the fact that three of the richest men in the country - whose firm, Partners Group, makes its money by investing in private equity - should stand “side-by-side” with small businesses is not ignored.

The Kompass Europa initiative, reminiscent of Christoph Blocher’s 1992 anti-EEA campaign, also criticizes minimal wage growth under current bilateral deals. It demands national votes on treaties that require Switzerland to align with EU laws.

Some prominent figures such as Kurt Aeschbacher support the PE executives, but experts suggest the initiative may come too late to influence the final negotiations.

The Insider Advantage

💡The Swiss-EU deal is likely to set the tone for Switzerland’s economy for the next half-century - if not longer. So far, it has inspired little heated debate. That could now change.

💡Swiss politicians are wary of strong anti-EU campaigns, especially since Blocher’s SVP successfully campaigned against EU membership and remains the country’s largest party.

💡The effects of Brexit on the UK economy are not being overlooked and inspire Swiss diplomats to get a deal done. But some hard, red lines may need to be crossed to get there.

🏥 The numbers that kill

Once again, health insurance is a killjoy.

And this year, the numbers may be as bad for insurers as for the insured.

About one-third of Swiss residents plan to change their health insurance provider for 2024 due to rising premiums.

These are set to increase by an average of 8.7%, bringing the monthly cost to CHF 359.50. This marks one of the highest premium hikes since 2010 and many households are feeling the financial strain.

These consistent premium increases over the past years have intensified calls for reform.

Some citizens are advocating for a single, unified insurance system to address the cost burden and improve efficiency.

The Insider Advantage

💡The Swiss insurance system - a model that reflects Obamacare in many ways - was meant to be a liberal-socialist compromise. All are required to buy basic insurance, but competition among providers should keep costs down.

💡The socialist health minister Elisabeth Baume-Schneider will feel the heat, both from lower and middle class voters who want financial support and from her more conservative government colleagues who see her as weak.

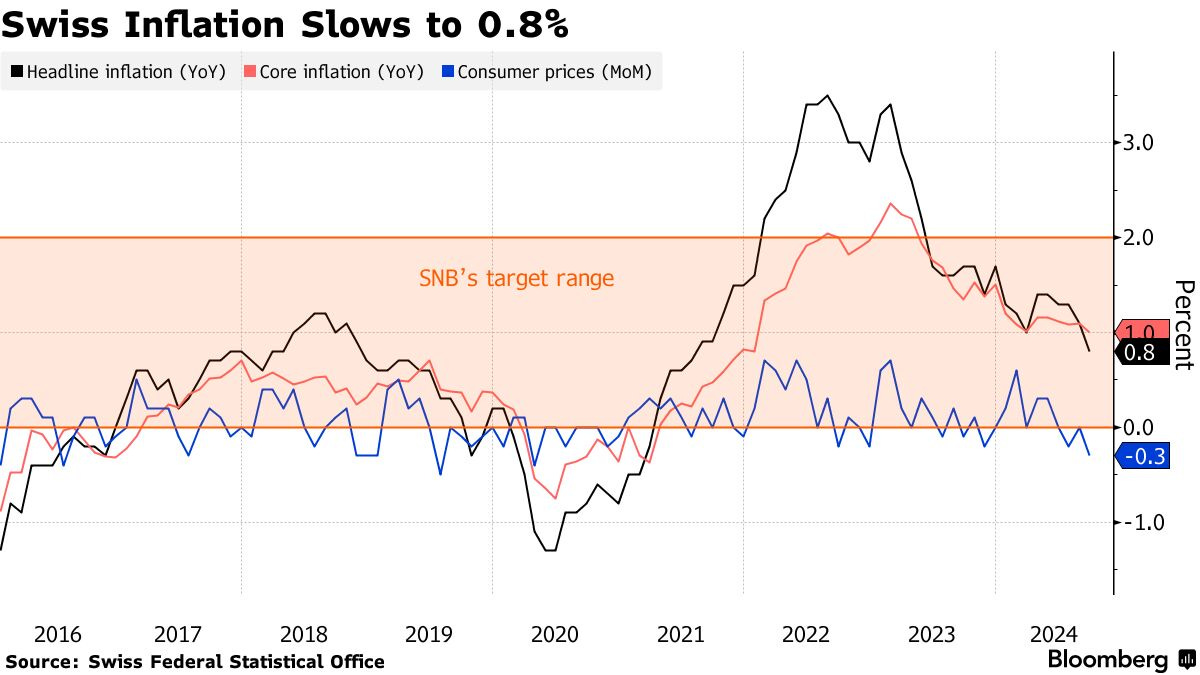

📈 A chart (or two) is worth…

Swiss inflation drops (again) to the lowest level in 3 years. The reading of 0.8% was below expectations of 1%. Deflation fears are beginning to be heard - with the potential to spur more rate cuts from the Swiss National Bank.

The Bonus

🚞 High-speed profits - The specialized railway systems that carry tourists up and down Swiss mountains experienced record profits in 2024. Again - (good) infrastructure wins. (Link)

😄 Best not smile - Swiss giant Migros continues to reduce its sprawling retail footprint by shuttering its cosmetic dental service Bestsmile. Diversification turned out to be a burden. (Link)

🛳 Maritime measurements - Switzerland takes the lead in pushing for CO2 taxes on shipping through the International Maritime Organization. Being a leading trading center puts Switzerland in the driver (pilot)’s seat. (Link)

Share this edition of The Swiss Insider with your network. They will thank you!