Dear Insider,

Tough times call for…tough talkers?

Not exactly the way to win a battle for the ages.

After all - talk is cheap.

But before the real fight begins, plenty of ideas will be discussed - as they are currently in Bern, where parliament wants to make Sergio Ermotti’s (personal) life much harder.

But as Switzerland’s biggest banker - he knows how to hold a hard line.

The same may…or may not…be said of Martin Pfister, who has been confirmed as Switzerland’s defence minister - and the man with the toughest job in government.

Time to buckle down…and buckle up.

Enjoy,

Ian

💥Quick hits

News bits and bites…short and (sometimes) sweet

🚫 Go home…

Immigration continues to be hot topic in Europe - and Switzerland

The upper chamber of the Swiss parliament has endorsed measures to tighten regulations around the treatment of asylum seekers involved in criminal activities.

The proposed changes aim to restrict the movement of asylum seekers under criminal investigation and facilitate the expulsion of those found guilty.

Now it will be up to Justice Minister Beat Jens (a socialist) to enact the recommendations…

✅ Confirmed

After the election of Martin Pfister to the Swiss Federal Council on Wednesday, the government has proceeded to confirm the “division of labor.”

As expected, Pfister will take over the VBS (Department of Defence and Sport) vacated by his party colleague Viola Amherd.

Now the fun…and hard work…begins.

🍯 Golden melting pot

Switzerland is a leader in gold refinery. And that is both good - and not so good…

In response to concerns over potential U.S. tariffs on gold imports, there has been a significant increase in demand for 1kg gold bars in New York.

As a result, Swiss refineries like Argor-Heraeus have been operating around the clock.

Why exactly?

To meet American demand, the refineries must recast larger 12.5kg London bars into the smaller U.S.-preferred size.

This surge has strained the supply chain, causing liquidity issues in London's gold market and highlighting inefficiencies due to differing bar size standards between markets.

📰 Person in the news - Sergio Ermotti

He is the face of “the bank” - of which there is only one now in Switzerland:

Sergio Ermotti - the banker’s banker.

His name moved to the top of the headlines this week for two reasons.

First of all, news from Bern.

The upper chamber of the Swiss parliament voted by a narrow margin to limit the salaries (including bonus) of top bank managers to CHF 5 million.

This would mean - yes - Sergio Ermotti would need to take a drastic pay cut…to the tune of about two-thirds.

Ouch.

At the same time, the big man made waves of his own…

In a recent discussion hosted by the IMD Alumni Club of Lausanne, Ermotti testily pointed out the main lesson of Credit Suisse was to be found in the bank’s own behaviour…and lack of regulatory oversight.

Speaking for himself and UBS, he pointed out that:

UBS today has a $1.5tn balance sheet

This is much smaller than the $3.9tn combined balance sheet UBS and Credit Suisse had in 2007 when 75% of assets were tied to investment banking

Assets in investment banking is now down to 29%.

Today, wealth and asset management makes up 60% of the bank’s business

UBS has a credit book of approximately CHF 350 billion

UBS has $185bn in total loss-absorbing capacity today – equivalent to almost four times the write-downs UBS incurred in the years following the global financial crisis.

Ermotti’s conclusion?

Don’t get hasty with new rules to limit the bank - they are not needed and could hurt consumers.

🏪 A fine flop

Not everything turns out so well in Switzerland…

In October 2024, the Swiss government launched a campaign - with good intentions - to encourage citizens to maintain emergency supplies - such as water, non-perishable food and other essentials.

The idea made sense given the growing global uncertainty - and even the prospect of a wider European war…

The campaign introduced, among other things:

An online calculator

An interactive educational video.

However, these tools saw minimal engagement.

Website visits dropped from 10,000 in October to 200 by December, and retailers reporting no significant increase in demand for emergency products.

Despite spending 60,000 Swiss francs, the campaign failed to significantly impact public behaviour.

Ooooops…

💸 Young, rich and Swiss

Most people think you have to be old to be rich…

At least that seems to be the stereotype in Europe - and Switzerland as well. But we all know that isn’t the case.

Here are 20 Swiss millionaires that are just getting started on life…

⬆️ Tariffs, tariffs on them all

Trade talk is tough these days.

Mostly because of one man…

In the US, President Donald Trump has implemented new 25% tariffs on imports of steel and aluminium products.

The measures affect not only raw materials but also processed goods. And this has a decidedly negative impact on Swiss tech products worth nearly one billion Swiss francs.

This sum represents almost 10% of all Swiss tech exports to the USA.

Stefan Brupbacher, Director of Swissmem, the association of the Swiss mechanical, electrical, and metal industries, spoke out this week with concern that escalating trade conflicts increase uncertainty, leading to reduced global investment in machinery and equipment

Obviously this would adversely affect Swiss exporters.

In light of this, Brupbacher emphasized the need for Switzerland to explore new markets and establish free trade agreements to safeguard domestic employment.

This becomes especially relevant in light of the looming domestic discussion around the new Swiss-EU bilateral agreement.

The Swissmem director is hopeful that the current geopolitical situation will allow Europe and Switzerland to find close alignment - and cooperation - in light of their common adversaries.

Make someone smarter about Switzerland

Why not take a minute to share this edition of The Swiss Insider - with your network, your colleagues…or with someone who will appreciate it?

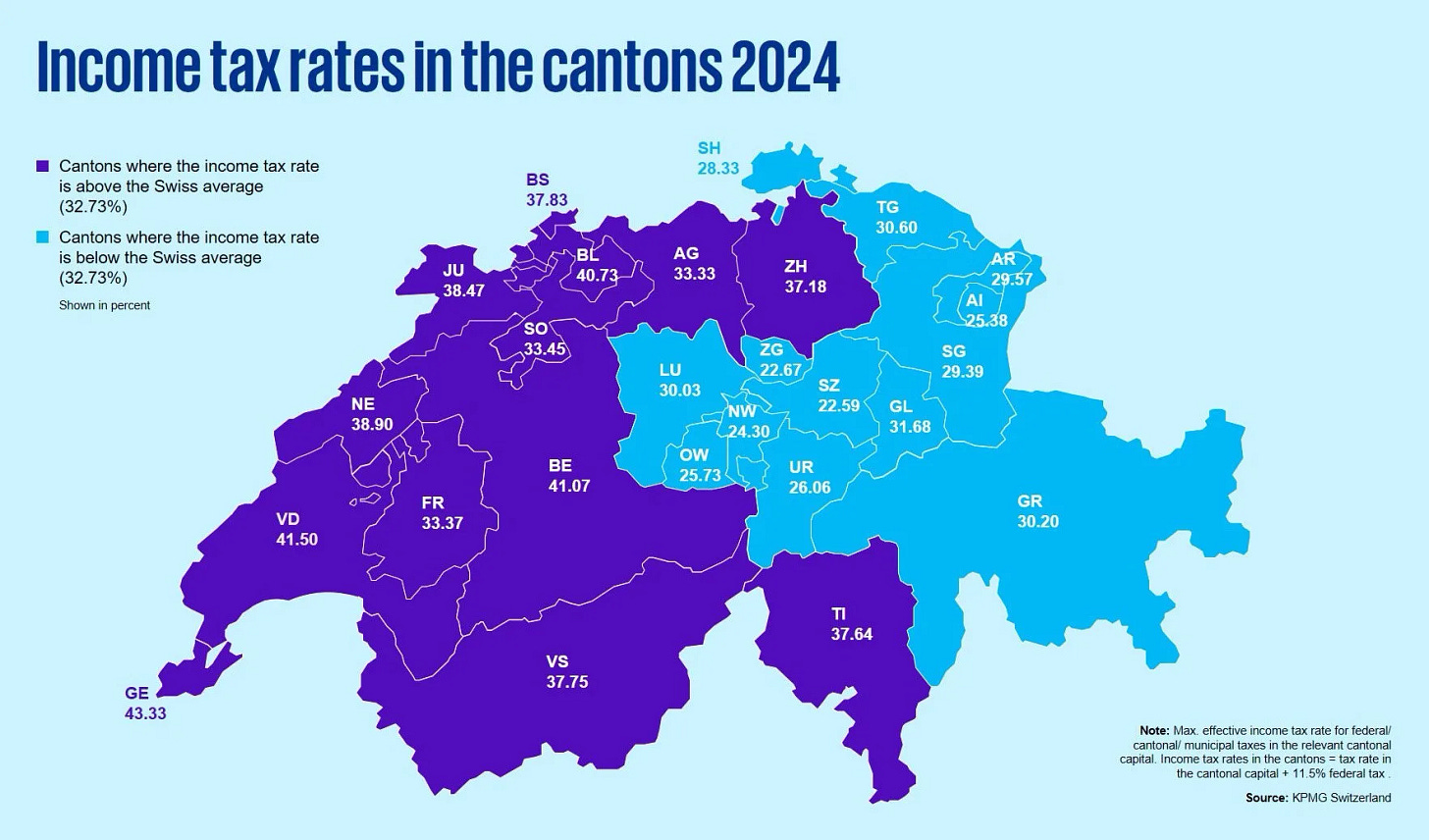

A Chart is Worth…

Does it matter where you live? For taxes in Switzerland - yes, of course…

The Bonus

🏦 Safe Street - US asset manager State Street will continue to oversee CHF46 billion in Swiss pension funds after lawmakers narrowly voted against a proposal to return control to domestic institutions. (Link)

✈️ Kissing the ring? - Swiss news reports that Swiss State Secretariat for Economic Affais head Helene Budliger Artieda is flying to Washington next week to meet with American officals - purpose unknown. (Link)