Dear Insider,

Leaders in Switzerland come in many shapes and sizes.

Many follow the age-old principle - so fitting in Switzerland - of “leading from behind.”

Whether this leads to success - and by extension “riches, fame and glory” - is debatable.

With the publication of the latest ranking of the 300 richest people in Switzerland, one might consider which type of leader/millionaire/billionaire is best.

(According the BILANZ, the rich have never been richer - big suprise…)

This week’s edition highlights one name on that list that is distinctly different - as well as a change in leadership that will likely have much more impact on Switzerland than the variable listing of the people with the most “dough.”

Enjoy,

Ian

💡PS: Feel free to connect with me on LinkedIn and on X. Or simply reply to this email and share your feedback. Thank you!

Person in the news - Hans Syz-Witmer

Hans Syz-Witmer is no ordinary banker. And so far that has been a good thing.

Among the 300 richest persons in Switzerland - the annual listing from BILANZ which is eagerly devoured by a curious public every fall, Syz-Witmer stands out…

…not for his wealth (“only” about 300 million CHF) but for other reasons.

What makes him special:

Besides being a blue-blood banker, Hans Syz-Witmer is also…an accomplished filmaker.

Having trained as a cameraman, he took over Turnus Film in 1989, transitioning to a producer’s role.

Under his leadersihip, Turnus Film, has produced successful films such as "Handyman" with Marco Rima and "Wolkenbruch's Wondrous Journey into the Arms of a Shiksa.”

Besides filmaking, Syz also served as the guild master of the Saffran Guild from 2002 to 2011, an organization that both his father and grandfather served.

How he has made his mark:

Syz’s leadership and entrepreneurial attitude has put Maerki Baumann on entrepreneurial path to success.

The private bank is one of the most innovative in Switzerland - and is one of the earliest Swiss banks in crypto having launched a cryptocurrency offering already in 2019 and recently setup a separate brand Archip to serve crypto wealth clients.

All in the family:

The name Syz is - like several others - a prominent one in the Swiss banking community.

Distant relations Marc and Eric Syz lead the western Switzerland-based Syz Group, which Eric founded in 1996.

🏦 The most innovative Swiss private banks

Maerki Baumann isn’t the only private bank in Switzerland that knows how to “keep up with the times.”

Here are 5 more innovative Swiss banks to look out for.

🔁 A change on the spot

Change comes swiftly sometimes. (Ex)changes too.

At the Swiss stock exchange SIX, this week brought a surprise announcement of a new Group CEO: current Global Head of Exchanges Bjorn Sibbern will step in to replace outgoing chief executive Jos Dijsselhof.

The later is (apparently) pursuing a “new opportunity” in a leadership role in the Middle East.

Sibbern - a former executive at Nasdaq - will take up his new role from 1 Jan 2025.

The Inside Look:

💡 Dijsselhof’s seven years at SIX come to an end after the Dutch CEO helped SIX weather a rough time in EU relations and with exchange equivalence briefly suspended by the bloc.

💡 The outgoing CEO also engineered the sale of SIX Payment Services to Worldline and led the Group to buy the Spanish BME exchange. In this respect, he has been a steady man at the top. It was exactly those qualities that probably made him a candidate to move on in a (perhaps) even bigger role.

🏡 Limits of the land

If you “snooze, you lose” as they say…

The saying now applies to landowners in Switzerland - in a new way.

The Swiss Federal Supreme Court has ruled that landowners may not receive compensation if their undeveloped land is rezoned out of building zones after 15 years.

This decision emphasizes that land designated for construction should be developed within the designated time frame.

Othewise, landowners will be left with a dime…er…hrappen.

The Inside Look:

💡 With housing a constant topic of conversation - and contention - the court’s ruling can have significant effects. For one thing, it aims to combat urban sprawl by keeping land zoned for housing restricted to near-term projects.

💡 Additionally, municipalities that were previously hesitant to rezone due to potential high compensation costs, may now proceed more confidently with zoning adjustments. And landowners will now be under increased pressure to develop their properties promptly or face the possibility of rezoning without financial restitution.

A chart is worth…

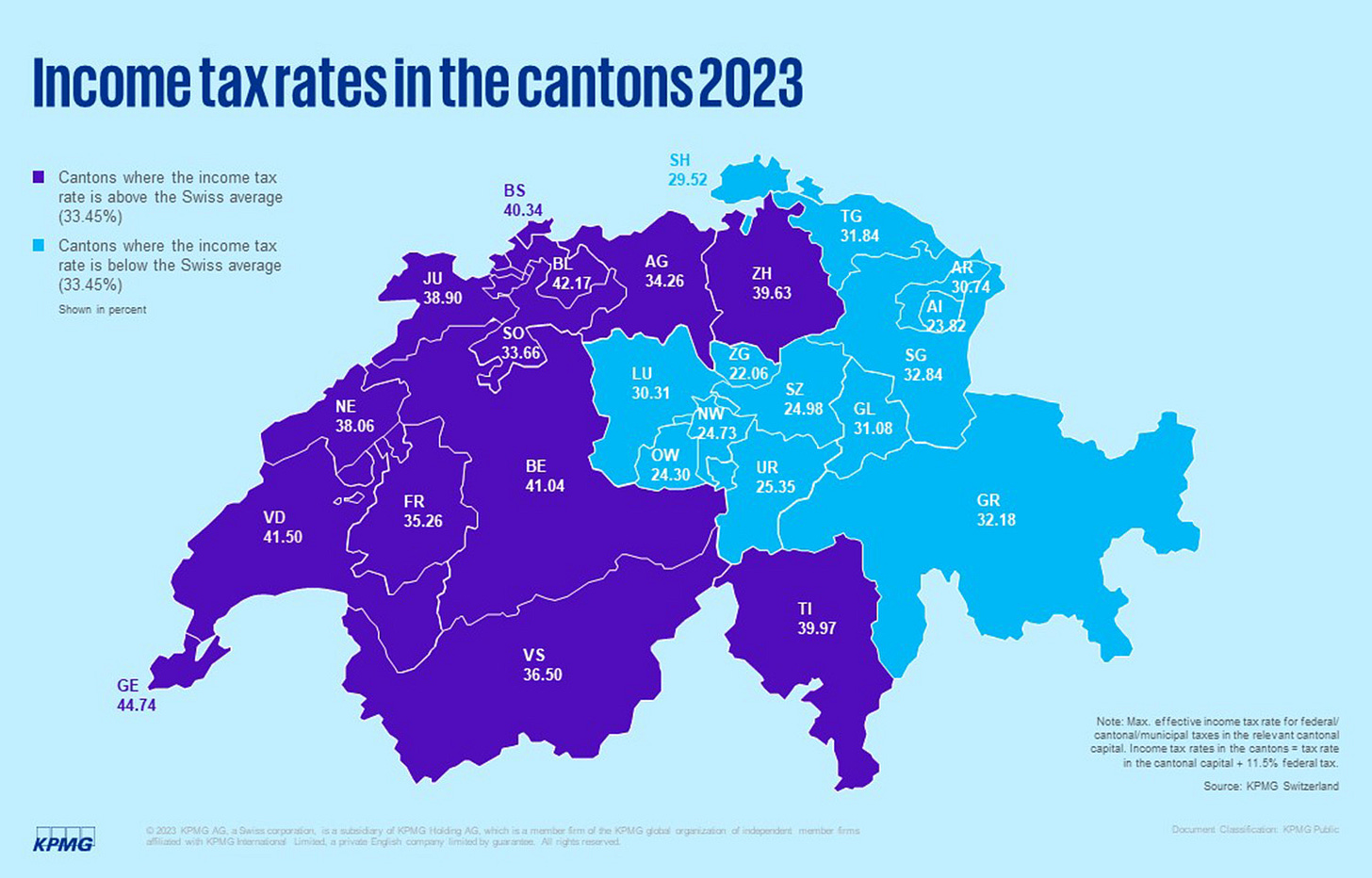

A map will tell the (tax) story quite well. Tax rates by canton show a distinct separation between west and east - and the French/Italian-speaking areas of Switzerland vs the German-speaking region.

🔁 Make sure to share this post with a friend or colleague - they will thank you!

The Bonus

❌ Bank busted - One of Switzerland’s most prestigious private banks, Lombard Odier, has been charged with “serious deficiencies in money laundering activities.”

The indictment stems from the bank’s work for the daughter of former Uzbekistan president Islom Karimov. (Link)

👋🏻 Second-hand success - Even Switzerland is getting enough of mindless consumption. Statistics show that nearly 50% of Swiss have bought a second-hand item online in the last months.

Meanwhile, the number of “thrift“shops has increased 12% since 2011. The entire second-hand industry is valued at 1.5 billion CHF as of 2022. (Link)

💰 Powerhouse partners - Swiss private equity giant Partners Group posted strong numbers ($1.2 billion) with investments into infrastructure. The jump in infra deals represents a 70% increase year-on-year.

Overall Partners Group manages over $25 billion in infrastructure investments, some with partners, some directly.