Dear Insider,

Time is supposed to heal all wounds.

However true it may be, the age-old adage is, unfortunately, small comfort for those who have suffered injustice and injury in years gone by.

Although the upheaval surrounding racial inequality and police brutality may not directly affect Swiss businesses, the tension and unrest continues to contribute to the cloud hanging over global businesses at the moment.

Of more immediate concern than the cruelty of lockdowns in days gone by are the knock-on effects of the preventative measures put in place to fight Covid-19. Now that restaurants and small businesses have returned to almost normal operations, the big question mark is whether 2+ months of sitting at home have significantly changed consumer habits.

This year’s lockdown has already force changes to the 2021 edition of the World Economic Forum. Klaus Schwab’s world-famous gathering will see its attendees cut by nearly one-third and digital links put in place to let delegates tune in from all around the world.

The throngs of angry protestors which have taken to the streets of major cities around the world will not weep for WEF. Too many will see this unforseen change as just reward for the lingering sins of globalization, Great Power dominance and Western aggression in Third World countries. Perhaps they are right…

Closer to home, another ghost is coming back to haunt one of Swiss banking’s brightest stars. Boris Collardi’s Julius Bär was the envy of all around as the bank grew by leaps and bounds during his tenure on Bahnhofstrasse.

Now FINMA is taking a closer look at the dynamic banker’s firm - and its failure to keep a handle on its risk appetite as it did deals around the world.

For once, a lockdown would have been good…apparently.

🔍 The Scoop

Inside takes that don’t necessarily make the front pages of daily news…

😷 Masks in the Making

One of Credit Suisse’s investment banking heavyweights (whose move to UBS fell through at the last minute) is up to something new. No, it’s not a mega deal to take over a Geneva private bank - as was anticipted. Instead, the banking star is jumping on the corona bandwagon and setting up shop to sell masks and respirators to those in need. Talk about opportunistic…

📜 Too Much Title?

What happens when you overdo it? You look foolish… Such is (apparently) the case with Credit Suisse’s Swiss Head Risk Management Serena Fioravanti - whose doctorate seems to be nothing more than a fabrication. It would not be the first time, of course, that those who move to the top were tempted to “polish the details” a bit too much… So much for integrity…

The Numbers Game

All the numbers that matter in Swiss business…

☀️ 24th

When it comes to renewable energy, Switzerland would seem to have the reputation of a leader in the field. But the actual facts say otherwise… Continent-wide, the country ranks a lowly 24th among producers of wind and solar energy.

38 billion CHF

Hard times have a hard effect on the Swiss economy. Part of those side-effects are the amount of work being done in the so-called “grey economy.” All together, a total of 38 billion CHF worth of work is done each year (a dramatic increase…) outside the lines of normal economic activity - with the result of 1.8 billion CHF in revenue and social security contributions lost.

👐🏻 3,4%

It is a small number compared to that of the United States - but still more than desirable. May saw the unemployment rate in Switzerland rise another 0,1 percent to 3,4% overall. That means an additional 165 000 unemployed persons who registered in May - out of just over 8 million residents in Switzerland overall.

📪 50 billion CHF

The great rebuilding plan for the Swiss Post and its PostFinance division continues. The plan, not without controversy, would see the financial arm granted the ability to start lending money to its customers, something that it currently is prevented from doing. Management would like to build out a book of loans worth 50 billion CHF by 2030.

🤓 Feeling smart?

Share your new-found knowledge…and this issue of The Swiss Insider!

The Briefing

In which we digest business news from around Switzerland - bit by bit…

📊 Doing the Dijsselhof

SIX - the national, bank-owned trading venue - has finally wrapped up its deal to buy European rival BME. The bold move by Chairman Jos Dijsselhof will see SIX pay $3 billion for the Spanish exchange - and give it an out in its continued struggle with the European Union which has tried to box the Swiss exchange in as part of ongoing trade negotiations.

🔪 Sharp As Ever

The name - and brand - is legendary…and known around the world. Victorinox is an icon of Swiss industry and has not been immune to the effects of corona. In spite of the fact that demand has fallen off, CEO Carl Elsener remains optimistic that the family-run business can flourish…as it has always done.

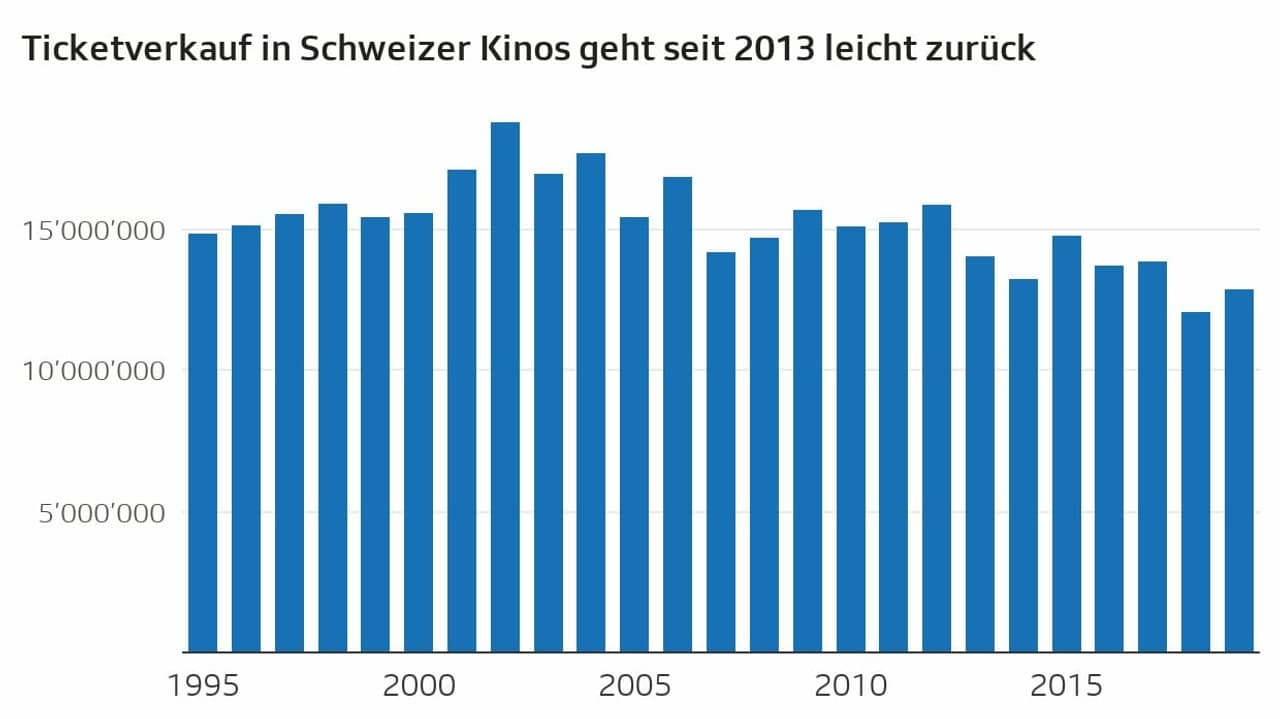

🎥 Failing Films

Movie theatres were an obvious first victim of corona preventative measures. They now face an uphill battle to recover as many who were confined their homes for 8 weeks or more discovered (if they didn’t know them already) the virtues of streaming. As shown by the chart above, the tendency in ticket sales had already been falling…and yet the industry has so far managed to stay strong. The future may not be so bad after all…