Dear Insider,

What’s in a handshake?

Trust, confidence, a closed business deal - and possibly a whole lot of germs.

As of recently, the simple handshake is now a big taboo, thanks to the ever-spreading coronavirus.

Switzerland has followed the rest of Europe in using the last week to push forward with measures to contain the outbreak that has grown steadily worse, especially in neighboring Lombardy, Italy.

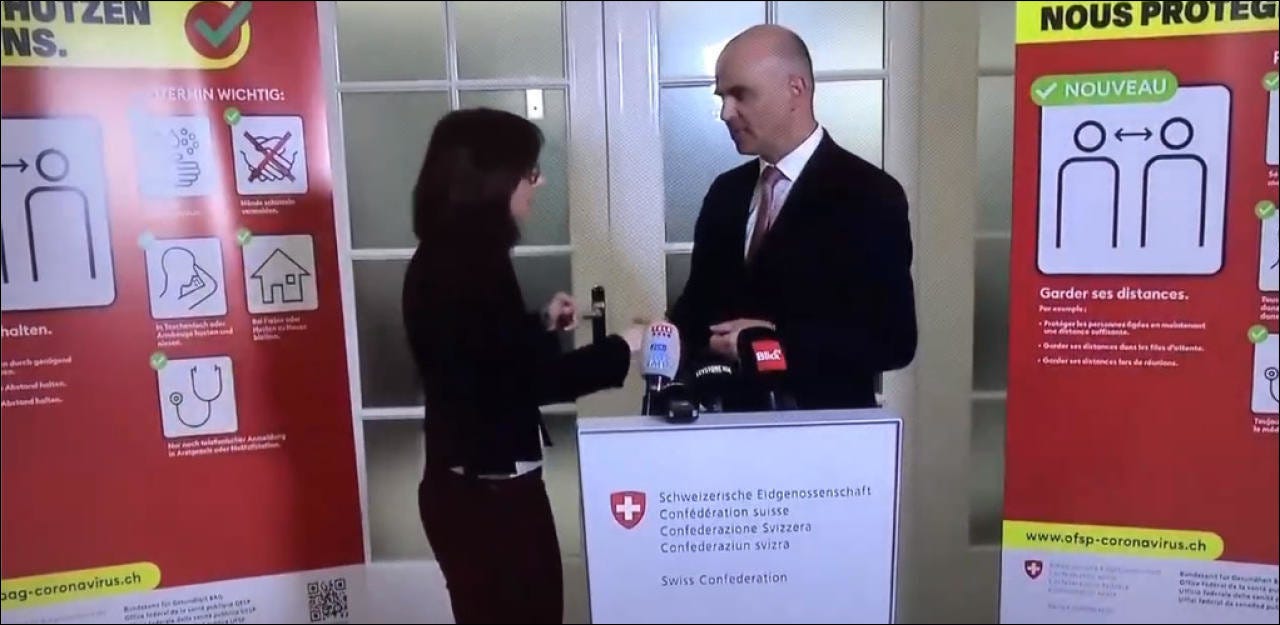

Health Minister Alain Borset and his team have used the well-oiled Swiss government machinery to roll out a widespread public information campaign - which was marred only by the minister’s unfortunate handshake on national television just after pointing out that such a gesture is not currently recommended…

The term being taken up now by government officials and business leaders alike is social distancing - supposedly the most effective way to help prevent the spread of a virus.

Quarantine, limited travel, no large public events - all perfectly understandable measures at a time such as this.

Some, however, are starting to question whether the outbreak will have longer-lasting effects. Could this be the start of a wider pullback from globalization and a greater “distancing” between nations, even within Europe?

For a country that has always kept its distance from war and other nasty entanglements, it might not seem to be a big deal.

But homegrown demand can only sustain the Swiss economy so long. Social distancing on an international level will certainly leave a scar that isn’t so easy to recover from.

It also highlights again the country’s relative lack of digitalization - and reliance on manual work, be it in offices, factories or on the farm. Now, those industries with the most automation and the most digitalized processes stand out as the most likely to weather the storm well.

In the meantime, here’s to being able to shake hands freely again…

What to Expect

A brief run-down of what to look for in this week’s edition of The Swiss Insider:

The Point - an analysis of Switzerland’s situation vis-a-vis the growing coronavirus crisis

The Numbers Game - the most important (and at times audacious) numbers to be had in Swiss business over the last week. (Look for largeness…because size matters.)

The Briefing - snippets of news designed to make you smarter and keep you abreast of the latest developments across the wide Swiss business landscape.

Twitter Takes - a short collection of tweets from across the Swiss business and political scene…

The Point

How bad is it? And how bad can it get?

The jury is still out on what coronavirus will do to the Swiss economy. A lack of tourists will certainly not help the tourism industry. The streets of Luzern, once a top attraction for Chinese and Indian tour buses, now ring hollow with fasnacht finished and no new visitors to replace the party-goers.

Some estimations point to a loss of up to 2,4 billion CHF and 0,3 - 0,4% less growth on the year. But the true impact is still unknown.

Few expect the Swiss National Bank to follow in the foosteps of the Federal Reserve and move to quickly drop interest rates. SNB chief Thomas Jordan has already faced enough grief over negative interest rates and with bank share prices heading south (see below), he will be hard pressed to make a cut. At the same time, a strengthening Swiss franc makes exporting harder than ever.

Already in Q4 of 2019, Swiss industry showed signs of slowing, much like Germany’s. The sole bright spot is the building industry which continues to grow, albiet slowly. Propped up by the need for safe investments for retirement funds, the home-building cranks on.

All-in-all there may be fair amount of trickle-down effect from travel restrictions and a slowing export market. However, a coordinted effort and strong measures by private companies have so far kept things from escalating dramatically.

The Numbers Game

In which we serve up some of the more interesting numbers in Swiss business…

4 billion CHF

The Swiss National Bank knows a windfall when it sees one — and that most certainly applies to the past year. Now the national bank is planning to give some of that back to local governements on the canton and municipality level. The grand total - 4 billion CHF.

150

One victim of the coronavirus outbreak has been air travel. (Just ask Flybe Airlines…) Naturally, some people may invent the wildest conspiracy theories, postulating that Greta Thunberg is somehow responsible for the virus. But that does not change the fact that almost 150 airplanes from SWISS and its mother company Lufthansa are currently not being used.

10%

The percentages do not lie. According to a study by Schilling, only 10% of the top jobs in the 100 largest Swiss corporations are held by women. A small start…

10 CHF

Who wants a deal? If buying bank shares is your thing, then there could hardly be a better time to stock up on UBS and Credit Suisse shares. Thanks to King Corona(virus), the two Swiss banks have seen their share prices tank even further, passing the 10 CHF mark…on the way down.

Want more?

Follow The Swiss Insider on Twitter for bite-size news as it happens - from Inside. #insidersdoitsmarter

The Briefing

In which we digest business news from around Switzerland - bit by bit…

(Swiss) REwind for Ermotti

Speculation was high that outgoing UBS CEO Sergio Ermotti had his eye on Chairman Axel Weber’s spot when the German was set to step down next year. To the surprise of many, Ermotti will head in a different direction, as he will step in to replace Walter Kielholz as Chairman at Swiss Re. Many noted that Ermotti may have been paying UBS back for its quick move to shove him out the door.

(Read the details on SRF News.)

Jumping chocolate

While coronavirus grabs all the headlines, another virus is causing a wicked jump in price for cocoa - that all-essential ingredient for Swiss chocolate. The CSSD (Cocoa Swollen Shoot Disease), as well as a bad weather, has driven prices up by 20% since the beginning of 2020. Analysts predict this could translate into a chocolate bar that is up to 14% more expensive for those with a sweet tooth.

(Read about it in Handelszeitung here.)

Keeping tabs on the investors

Currently there are at least 13 countries worldwide which place restrictions on foreign investors looking to move large amounts of capital into a country. Now Switzerland could follow suite as Parliament has instructed the Federal Council to draw up a plan to place limits of foreign money flowing into key industries. China will be the main target…

(Read more from Der Bund.)

Start it up

Official statistics declare that 99% of Swiss businesses qualify as SMEs - with under 120 employees. That doesn’t mean there are that many startups in the country, however. Now a parliamentary group spearheaded by Judith Bellaiche (Swico) and Andri Silberschmidt (Nationalrat - Zürich) wants to put more pressure on Bern to pay attention to the needs of young entrepreneurs. They are backed by the Swiss Entreprenurs Foundation, under the patronage of former Federal Councillor Johann Schneider-Ammann.

(Read all about it in Handelszeitung.)

Happy to be Inside?

Share The Swiss Insider with someone who should be in the know…

Twitter Takes

A collection of tweets from across the Swiss business and political scene…

Sergio Ermotti gets emotional about joining Swiss Re…

The people hoarding supplies against coronavirus effects

Gloom and doom for Swiss economy?

What Credit Suisse doesn’t need on its plate right now…