Dear Insider,

A new year often brings with it new things - new opportunities, new energy and new life.

It may also bring old problems…which are all too familiar.

Two cases of men behaving badly had different, negative - though oddly similar - effects on Switzerland this past week.

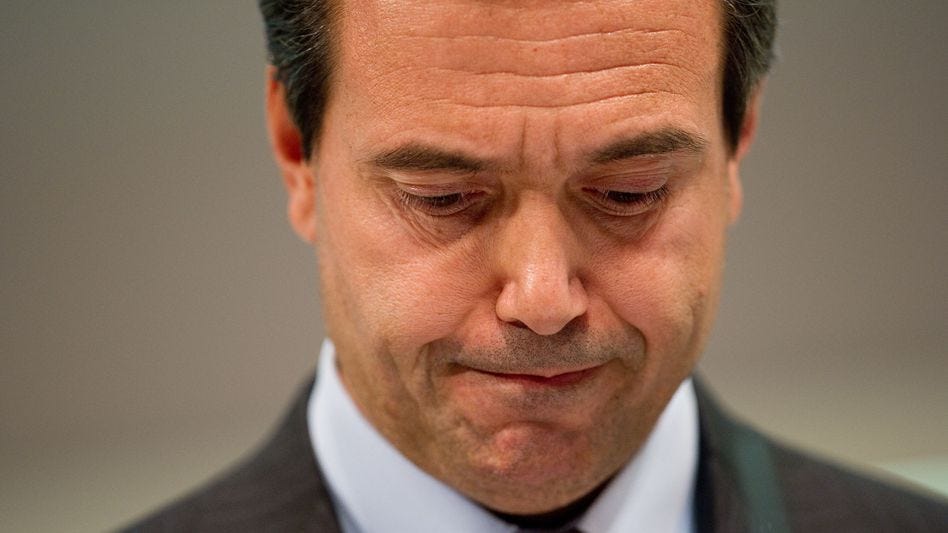

TOP STORY - The man is gone…again.

It wasn’t supposed to be this way…

After scandals, spying, and sorry results - Antonio Horta-Osorio was tipped to be Credit Suisse’s big savior. His arrogance and covid-rule flouting took him down after only 8 months.

Two trips out of the country without following quarantine rules, plus clumsy attempts to cover up the fact, made it clear that Horta-Osorio could not stay on.

What has also become clear from insiders is that his imperious demeanor and lack of humility made him an easy target.

It is a major blow to the 2nd-largest Swiss bank - whose shares have slid 25% recently. Making amends and keeping focused - while still also making money - will be a challenge.

There is nothing like a monumental challenge to encourage humility…

Far(ner) and away

Leading Swiss communications and branding agency Farner Consulting has its sights set on foreign expansion. To reach its goal of becoming a dominant player in Europe, the 70 year-old firm has enlisted private equity shop Waterland to source potential M&A targets.

The first area of expansion will likely be the German-speaking DACH region, with further targets in the Nordics and Benalux.

An aggressive expansion policy like that of Farner is a rarity for Swiss firms. Those who do major business internationally tend to be export firms - not consultancies.

Speculation of impending Euro-Swiss franc currency parity may make it attractive for more European-wide among Swiss companies who can afford it.

Setting up for a fall

Novak Djokovic may be a world no. 1 in tennis but he is becoming headache no. 1 for some beyond the sporting world. His close contact and sponsorship and promotion agreements are now taking a hit after he was deported from Australia.

For several years, Djokovic has been closely associated with Lacoste and receives millions to promote its gear.

Lacoste, as well as department store Manor, belong to venerable Genevan enterprise Maus Frères.

Rumors report that Maus Frères has sought to hold talks with Djokovic since his covid affair prior to the Australian Open - but so far to no avail.

Go ahead - share this post!

Someone will thank you for it…

Not too shabby

Leading Swiss retailers Migros and Coop both posted record profits in 2021. The former grew its revenue by more than

n 2% to CHF 28,8 billion. Its good run during the corona pandemic did not, however, allow it to overtake Coop which grew at a 5,4% rate and hauled in CHF 31,8 billion.

Ecommerce continued to see strong growth thanks to lockdowns and more. Migros added 15% growth in its online sector.

Migros sidekicks, Migrolino and petrol chain Migrol also accounted for particularly strong growth at 4,3% and 18,3% respectively.

According to Deloitte, both companies remain among the prestigious ranks of the Top 50 retailers in the world.

Good, but not good enough

The OECD is generally happy with Switzerland - especially with its economy. Its latest report had good things to say about the country. But the picture is not all rosy…

Further reforms to the retirement system are needed to avoid trouble down the road. The OECD continued to recommend that men and women have the same retirement age.

Meanwhile, the OECD report praises Switzerland for having come through the covid crisis in extremely good shape.

The country’s GDP is expected to grow at a healthy clip of 3%.

Continued high prices for real estate were also highlighted as an area of concern.

Changing times

Money is on the move - literally - at the SIX Swiss exchange. That is its role, after all. In a detailed interview, 56-year-old SIX CEO Jose Disselhof (in his post for nearly 4 years now) shared his thoughts about the future of the exchange…and the money it deals with.

…record volumes on SIX - and to record profits are not proof that in a volatile market ‘the bank always wins.’

7000 ATMs in Switzerland are definitely too many. The system of the future will likely see ATMs serviced exclusively by a 3rd company.

Homegrown contactless payment system TWINT has now over 4 million active users. But the next step is to expand the service beyond Switzerland.

SIX would be generally glad to see a positive result in the upcoming referendum which would eliminate the 1% stamp duty for firms who raise capital.