Dear Insider,

As hard as it is to go - sometimes it’s even harder to comeback.

In the USA, Donald Trump made it look easy. In the world of Swiss football, another household name has “come home” and with dramatic results: Xherdan Shaqiri

His bosses at FC Basel, where the short, stout footballer rose through the youth ranks and helped the team win 3 league titles, are celebrating too.

Find out why below…

Meanwhile, another revolving door has turned again at Leonteq Securities. This one due to something closer to an “own-goal.”

Enjoy,

Ian

💡PS: Let me know what you like (or don’t) about The Swiss Insider. Drop me a message on LinkedIn here.

⚽ The (profitable) prodigal son

Coming home is a good thing…and can be highly profitable too.

And Swiss football star Xherdan Shaqiri's return to FC Basel proves the point.

The club has reported an average of nearly 26,000 spectators per home game this season, a 17% increase from the previous season.

Season ticket sales have risen by 10%, reaching approximately 16,500.

On top of that, FC Basel has sold around 25,000 jerseys this season, with 4,500 bearing Shaqiri's number 10 sold within weeks of his return.

While Shaqiri's presence has undeniably attracted more fans, FC Zürich's president, Ancillo Canepa, believes the overall rise in Swiss Super League attendance is due to the competitive nature of the league.

In other words…a return to the future…

🔎 Low-down on Leonteq

Once upon a time, Leonteq was a rising star in the Swiss finance scene. Its star may be headed in another direction now.

The agile, dynamic spirit that propelled the structured product specialist to the top of the conversation on Paradeplatz has slowly turned sour…

Here’s why:

The numbers don’t lie

First of all, Leonteq's recent financial performance has been disappointing, with a significant decline in profits and a drastic reduction in dividends.

The company reported a net profit of 5.8 million CHF for 2024, a sharp decrease from the combined 312 million CHF in 2021 and 2022.

Consequently, the dividend has been cut from 3.00 CHF to 0.20 CHF per share. These results have led to a substantial drop in Leonteq's stock price.

On (and off) the hot seat

In response to these challenges, Leonteq has appointed Christian Spieler, a former advisor at Bain & Company, as the new CEO. Former CEO Lukas Ruflin, under whose tenure the company faced significant challenges, has transitioned to the board of directors.

Spieler, whose background includes stints at JP Morgan and Citigroup, is tasked with steering the company away from its current difficulties….and back on its “rocket-ship” course upwards.

This leadership change at the top comes amid increased regulatory scrutiny, with the Swiss Financial Market Supervisory Authority (FINMA) requiring Leonteq to hold more liquidity, impacting its operational costs.

This move has raised concerns due to his previous involvement in controversies, including undisclosed transactions through offshore entities, which led to fines from regulatory bodies.

On top of all this, the relationship between Leonteq and the law firm Niederer Kraft Frey (NKF), represented on the board by Philippe Weber, has been questioned due to potential conflicts of interest arising from substantial legal fees paid to NKF.

Quite a sorry salad….

🇨🇭All about Switzerland

You read The Swiss Insider…and you want more.

Good.

Check out more detailed insights on: Swiss crypto lawyers, rising stars in Swiss banking, Swiss business clubs…and more.

💵 Show us the money

Got money?

That’s the question that circulates in the minds of all (Swiss) startups… And the latest edition of the Swiss Venture Capital Report has the answer…

Here’s the breakdown:

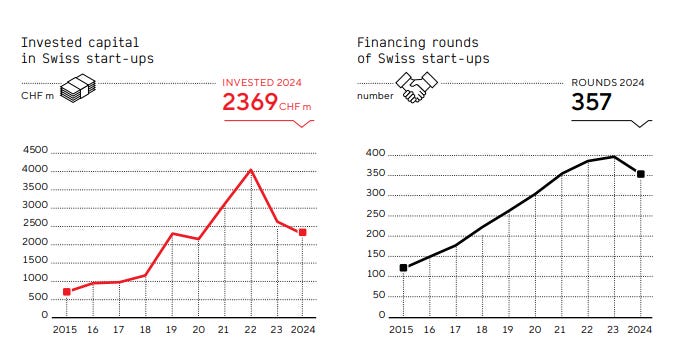

In 2024, Swiss startups secured CHF 2.4 billion in venture capital, marking a 30% decrease from the previous year.

The number of financing rounds also declined by 20%, totaling 250.

Despite this downturn, the Swiss startup ecosystem remains robust, with sectors like ICT and life sciences continuing to attract significant investments.

The decrease aligns with global trends, as international venture capital investments have also seen reductions.

I know you are enjoying The Swiss Insider…

Why not take a minute to share this edition of The Swiss Insider - with your network, your colleagues…or with someone who should “get inside.”

A Chart is Worth…

Up…and down - total capital raised and total number of financing rounds for Swiss startups saw a moderate decline in 2024 - as illustrated by the most recent edition of the Swiss Venture Capital Report 2024.

The Bonus

🏦 Digital takeover? - Swiss-Brazilian bank J. Safra Sarasin is reported to be in talks to take over Saxo Bank, the digital brainchild of Lars Seier Christensen. (Link)

🛒 Chinese shopping - A recent survey indicates that 75% of Swiss Generation Z consumers have purchased from Asian online platforms like Temu and AliExpress. (Link)

📺 So long, farewwell - Swiss national radio and TV broadcaster SRF is under pressure to cut its budget. One victim will be the popular G&G show, featuring famous faces and glamours gossip. (Link)