Dear Insider,

Coming and going - there is a lot of it going on these days.

Often the changes that happen - especially at the top of a company or government - bring anxiety. What should we expect now?

For those monumental moments, and for the bad ones in particular, there is a remedy.

It’s called insurance.

But even that isn’t always so sure. Swiss Re’s sudden CEO change proves that things can take a twist very quickly.

And Zurich Insurance’s pledge to change its involvement with oil and gas projects is sure to inspire some angst in that industry - and also some head-scratching, given the mixed signals it sends.

Maybe that is why the people of canton Uri want to double check an ambitious project going on in their backyard.

It never hurts to really “be sure”…

📢Person in the News

New Swiss Re CEO Andreas Berger

It came as a surprise to most - but one of Switzerland’s largest insurance companies is leaving town. Christian Mumenthaler will step down as of 1 July 2024 and be replaced by Andreas Berger.

Mumenthaler served at his post for 8 years and during his tenure, he significantly increased the company's earned premiums from about 30 billion USD in 2015 to 45 billion last year.

Lingering questions remain, however, about how effective he was in helping Swiss Re keep up with other big insurance rivals.

🔪Two Knives and a Hammer

How to deal with banks like Credit Suisse

The details:

Credit Suisse has experienced (at least) two sharp knives in its history. It may be about to get familiar with a hammer.

In 2001, John Mack became CEO of Credit Suisse First Boston. By his own account, he slashed over $1 billion in costs before he eventually ran into a Swiss stone wall and left four years later.

Ulrich Körner, the last CEO of Credit Suisse, also earned a well-deserved reputation as a cost-cutter. His zeal took him so far as to earn the nickname “Ueli the Knife.”

Neither man, however, could save the big bank by their sharpness.

The big picture:

Which makes it all the more interesting to see what kind of “hammer” Stefan Walter, the new CEO of Swiss regulator FINMA will be. A German by birth and a regulator by blood and background, Walter is tasked primarily with keeping UBS from repeating the mistakes of its now defunct rival.

The lesson:

Personalities at the top may be effective - like Mack and Körner were in their day. But the tools and the people must fit the task and the challenge of the day. Whereas streamlining budgets may have helped the bottom line and pacified shareholders, it will take more than a knife - and a hammer - to keep UBS and its ugly Credit Suisse stepchildren - on the “straight and narrow.”

❗️❗ Be sure to follow The Swiss Insider on LinkedIn - right here.

💨Inflating away

When the SNB looks like a wizard

The details:

Switzerland is a leader in fighting inflation - the biggest battle the world currently knows, besides the fighting on the eastern border of Ukraine.

It helps, of course, that prices are high already and a strong Swiss franc acts as a passive defense weapon. Now with inflation falling to 1% in March, Switzerland is leading the way again.

The downward trend makes the SNB and Thomas Jordan look like geniuses for having cut rates already a month ago.

Did they have a magic crystal ball? No - just strong data, a strong focus on economic infrastructure and strong conviction in their insights.

The lesson:

We should all envy the luxury of making small adjustments with low risk and decent outcomes. This is the model demonstrated by the inflation battle in Switzerland. It underscores again the value of well-oiled, finely tuned machines - in this case, the Swiss economy.

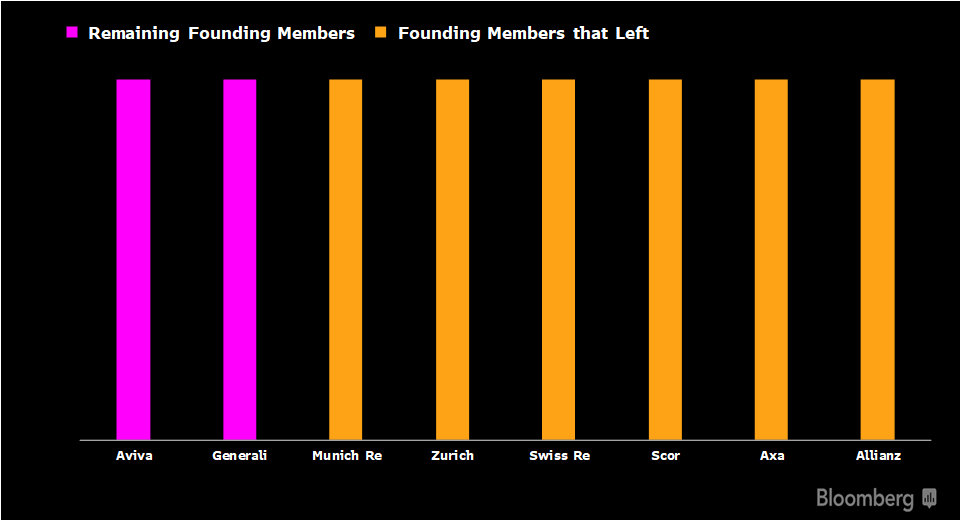

📈A chart is worth…

Most founding members of the Net Zero Insurance alliance have departed - including Swiss insurers Swiss Re and Zurich Insurance.

🛳️A rising tide

Semih Sawaris meets resistance in Uri

The details:

The conflict between left and right sometimes flares up in curious places.

The latest confrontation between concerned environmentalists and ambitious billionaires is taking place in one of the three original cantons of Switzerland where Egyptian billionaire Samih Sawaris is trying to build a yacht harbour.

His dream - as he calls it - has been to open up the town of Seedorf UR to more tourism by letting the rich dock their yachts there. He has one or two himself, of course.

Thanks to the support of Heidi Z'graggen, a former councillor in the area, a municipal merger was arranged which helped reduce the percentage of 2nd homes in the combined towns. The upshot?

More room to build and invest in new vacation homes for a profit.

Sawaris is happy.

What probably won’t make him so jolly is the growing resistance to his yacht harbor plans. Even after having reduced the size of the project - the locals and Green Party activists aren’t buying in.

Instead, the “No” camp has organized itself around an “Isleten for all” campaign hoping to stir up opposition even more.

The lesson:

Sawaris has made a name for himself by almost single-handedly creating an economic miracle in canton Uri. His Andermatt project has attracted serious investment and growth. Some people, however, don’t like the idea of a “rising tide that lifts all boats” - especially if they are yachts.

The Bonus

❌ Zurich Insurance says stop - The Swiss insurance group has announced it will no longer underwrite new oil and gas projects. (Link)

🫱🏻🫲🏻Safer Swiss power - A multi-factional political action group is pushing for new rules to make Switzerland’s power infrastructure more secure. (Link)

Share this edition of The Swiss Insider with your network. They will thank you!