Dear Insider,

Tragedies strike when we least suspect.

And sometimes, they come from a direction we might never expect - above.

The residents of Blatten - that small, idyllic village nestled deep in the Swiss Alps - would never have expected that the grand and glorious mountains around them would ever be shaken or moved.

But they were.

Even as nations continues to come to grips with a world order in flux and international relations that seem to be crumbling - the “moving mountains” metaphor was even more real for some people this week.

Think of them,

Ian

P.S. Life is short - also for the wealthy in Switzerland. Which is why even if Swiss millionaires have gold in an alpine vault…

…they probably also have a life insurance policy…or two.

And they might have them from one of these 7 Swiss life insurance companies.

💥Quick hits

News bits and bites…short and (sometimes) sweet

On the road

The Swiss love to travel. But how much…actually?

In 2023, the average Swiss resident took just under three overnight trips, with one typically domestic.

Women traveled more than men, and the most active age group was 25–44. Zurich and Central Switzerland led in travel frequency, while Ticino lagged behind.

Popular destinations included cities, with Germany and Italy topping the international list.

Notably, 36% of trips stayed within Switzerland.

Post-COVID, travel has become more deliberate—fewer, longer trips and a rise in group travel reflect changing habits.

Tariff kick

International trade turbulence is making itself felt in the Swiss market.

Swiss exports fell in April by 9.2% (seasonally adjusted) to CHF 25.23 billion, following a surge in March driven by anticipatory shipments ahead of expected U.S. tariffs announced by President Trump.

This decline reflects a normalization after the March peak. Notably, exports to the U.S. had spiked by 149% in March due to these anticipatory measures.

Excluding this effect, April exports would have decreased by 6.4%.

The chemical and pharmaceutical sector experienced a significant downturn, with exports dropping by 17.1%, primarily due to a nearly 44% decrease in medication shipments.

At the same time, the machinery, electronics, and precision instruments industries saw modest growth.

Consider sharing this post - someone will get smarter if you do!

Person in the News - August Hatecke

It pays to push…until it doesn’t.

For top bank managers, who live under pressure to sell more, the line between “not enough and “too much” is very fine indeed.

One man in particular is embodying this truth right now: August Hatecke, UBS’s Head of Wealth Management Switzerland.

Why?

Over the last weeks, the big bank has embroiled in a derivatives scandal involving significant losses for wealthy clients who invested in complex USD products.

Hatecke stands accused of aggressively promoting these products, pressuring advisors to sell them, and side-lining internal warnings about their risks.

Despite this, Hatecke is reportedly shifting blame onto a subordinate. UBS is now offering up to 95% compensation to affected clients, indicating acknowledgment of its own responsibility in the matter.

Flattened and flooded

The mountains of Switzerland seem invincible - and unmoveable.

Spoiler alert: They’re not.

On May 28, 2025, the village of Blatten in the Lötschental valley in Valais, was devastated by the collapse of the Birch Glacier.

The resulting landslide buried approximately 90% of the village under nearly 10 million cubic meters of ice, rock, and mud.

The force of the collapse registered as a magnitude 3.1 seismic event, and the debris field stretched over 2 kilometers in length and up to 200 meters in width.

Thanks to early warnings from geologists and swift action by cantonal authorities, around 300 residents were evacuated on May 19, just days before the event, minimizing casualties.

The collapse also blocked the Lonza River, forming a natural dam and temporary lake, which raised fears of downstream flooding.

The Swiss federal and cantonal governments responded decisively. President Karin Keller-Sutter visited the region shortly after the disaster, offering federal assistance and moral support.

Rescue operations were coordinated with geological monitoring, hydrological risk assessment, and infrastructure management. Relief and recovery teams remain on high alert due to ongoing risks of further landslides or flooding.

Climate to blame?

The incident has intensified public debate about the role of climate change in Switzerland’s increasingly unstable alpine terrain.

Scientists link the collapse to rapid glacier retreat and thawing permafrost, both of which weaken the structural integrity of mountain slopes.

Swiss glaciers lost 10% of their volume between 2022 and 2023 alone, a record rate attributed to global warming.

Bring it back

Early estimates to rebuild or repair the village place the cost at several hundred million Swiss francs.

Given the scale of destruction, a full reconstruction of Blatten in its original location is unlikely.

Authorities are considering whether to relocate the village entirely. Most structures were reduced to rubble, and infrastructure such as roads, bridges, and water systems was severely damaged.

Swiss Defense Minister Martin Pfister visited the disaster area in Blatten (Lötschental) following the recent glacier collapse and landslide.

He confirmed that around 70 Swiss Army personnel will remain on site to support ongoing operations, particularly in clearing debris, securing the area, and helping local authorities manage the aftermath.

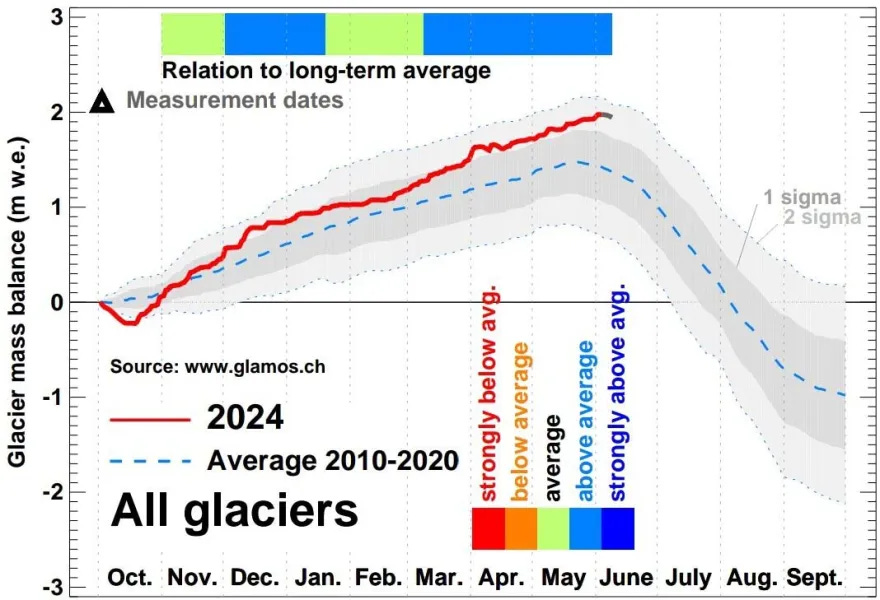

A Chart is Worth…

The future for Switzerland’s glaciers does not look good…if 2024 is any indication.

The Bonus

🏭 Saving steel - Two major Swiss steel manufacturers, Swiss Steel Group and Debrunner Acifer, have applied for emergency state aid due to ongoing financial difficulties. (Link)

🏨 Luxury delisting - Orascom Development Holding (ODH), led by Samih Sawiris, is delisting from the Swiss stock exchange on June 5, 2025, after years of underperformance. Despite the success of The Chedi Andermatt and a booming Swiss luxury hotel market, ODH's stock plummeted from CHF 152 at its 2008 IPO to below CHF 5. (Link)

🏠 Tighting up - The Swiss Financial Market Authority FINMA has issued a stern warning to banks, who it considers to be too generous with its mortgage business. (Link)