Dear Insider,

In a multipolar world, identity is fluid.

One day your worst enemy could help you out. Tomorrow the best of allies could turn against you.

Judging by the commentary at the 2nd annual American-Swiss Leadership Summit this past week - the US and Switzerland bond of friendship has never been stronger.

Some might dispute that.

Read more below to see why it might not matter…

Of course, bankers feel the “flux” as well - one day you are a superstar, the next you’re out of a job.

If your speciality is Russian clients - the danger of crossing the line from friend to foe is even greater…

This week’s edition of The Swiss Insider covers both perspectives.

Enjoy,

Ian

P.S. You’d be surprised - there are a lot of things that (even rich…) people don’t know about Switzerland.

Like how to structure family offices or get access to private equity investments.

It’s too bad, really…

💥Quick hits

News bits and bites…short and (sometimes) sweet

Slim and slimmer

Julius Baer has been through the ringer.

It didn’t necessarily come out of the René Benko scandal (and others previously) looking very good.

Now new CEO Stefan Bollinger is trying to get a handle on things with a raft of cost-cutting measures - and new (not too ambitious) targets.

The bank has said it was aiming for a cost-to-income ratio of less than 67 per cent by 2028, which is weaker than a previous target of 64 per cent by 2025

It plans to exceed its previously announced SFr110mn gross cost savings target by SFr20mn by the end of 2025.

There are no updates on planned changes to risk management policies….

Student spies

Can you study and spy at the same time?

Unfortunately, yes…

That’s why Swiss universities are increasingly concerned about espionage, particularly in fields like rocket engineering, quantum research, and supercomputing.

The Federal Intelligence Service has warned that foreign agents, especially from China, may pose as researchers to access sensitive information.

In response, Centre Party National Councillor Reto Nause has proposed mandatory security checks for students from high-risk countries—such as China, Russia, Iran, and North Korea—applying to programs with potential military applications.

He argues that it's naive to ignore the threat of knowledge transfer to authoritarian regimes.

The Swiss Federal Council acknowledges the issue but recommends rejecting Nause's motion, preferring to wait for the outcomes of two working groups expected to present proposals in the second half of 2025.

Meanwhile, institutions like ETH Zurich have already implemented stricter admission controls in sensitive disciplines.

Who should learn about student spies in Switzerland?

Share this post with them - and make them smarter. (They will thank you!)

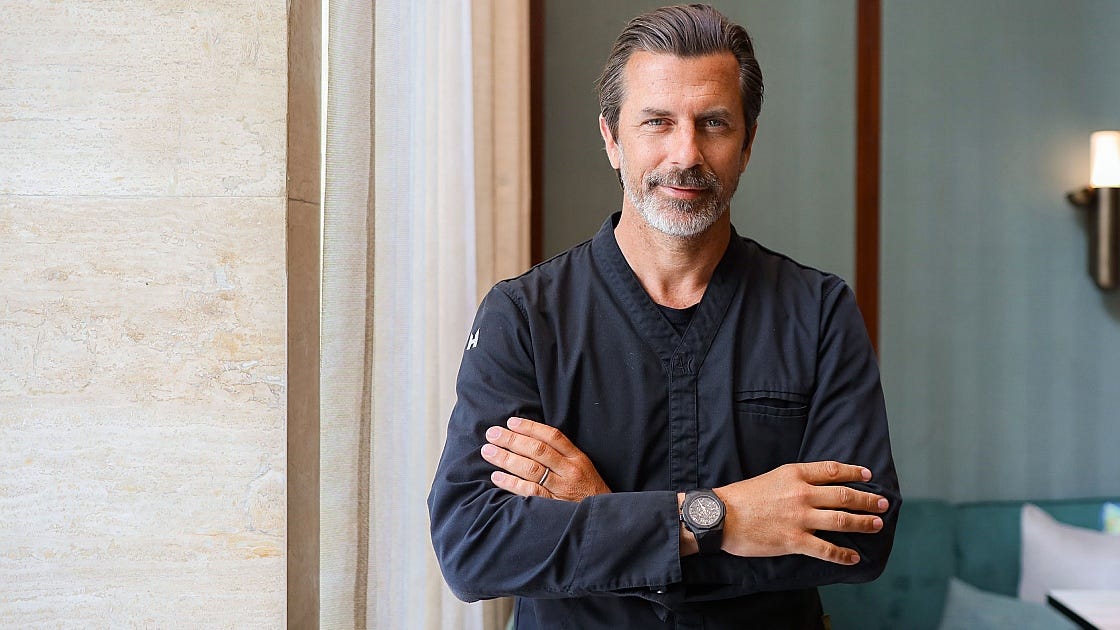

Person in the News - Andreas Caminada

An icon of the Swiss culinary arts - Andreas Caminada is not quite a household name…but close.

And these days he isn’t happy.

The Grand Hotel Bad Ragaz announced this week that as part of a major renovation, it would be closing the award-winning, Caminada-led restaurant Igniv.

Was it a bad oyster? Not exactly…

The “breakup” seems to be based on (surprise, surprise…) financial considerations. As the headline draw for Igniv, Caminada took a slice of the restaurant’s profits. Now the five-star hotel wants to cut him out.

What does Caminada have to say about it?

The chef finds the decision "not comprehensible" from a business perspective, noting that the restaurant had received international acclaim and was a regional flagship.

The Grand Resort intends to operate its own restaurants post-renovation, focusing on Italian and Thai cuisine, thereby eliminating licensing fees.

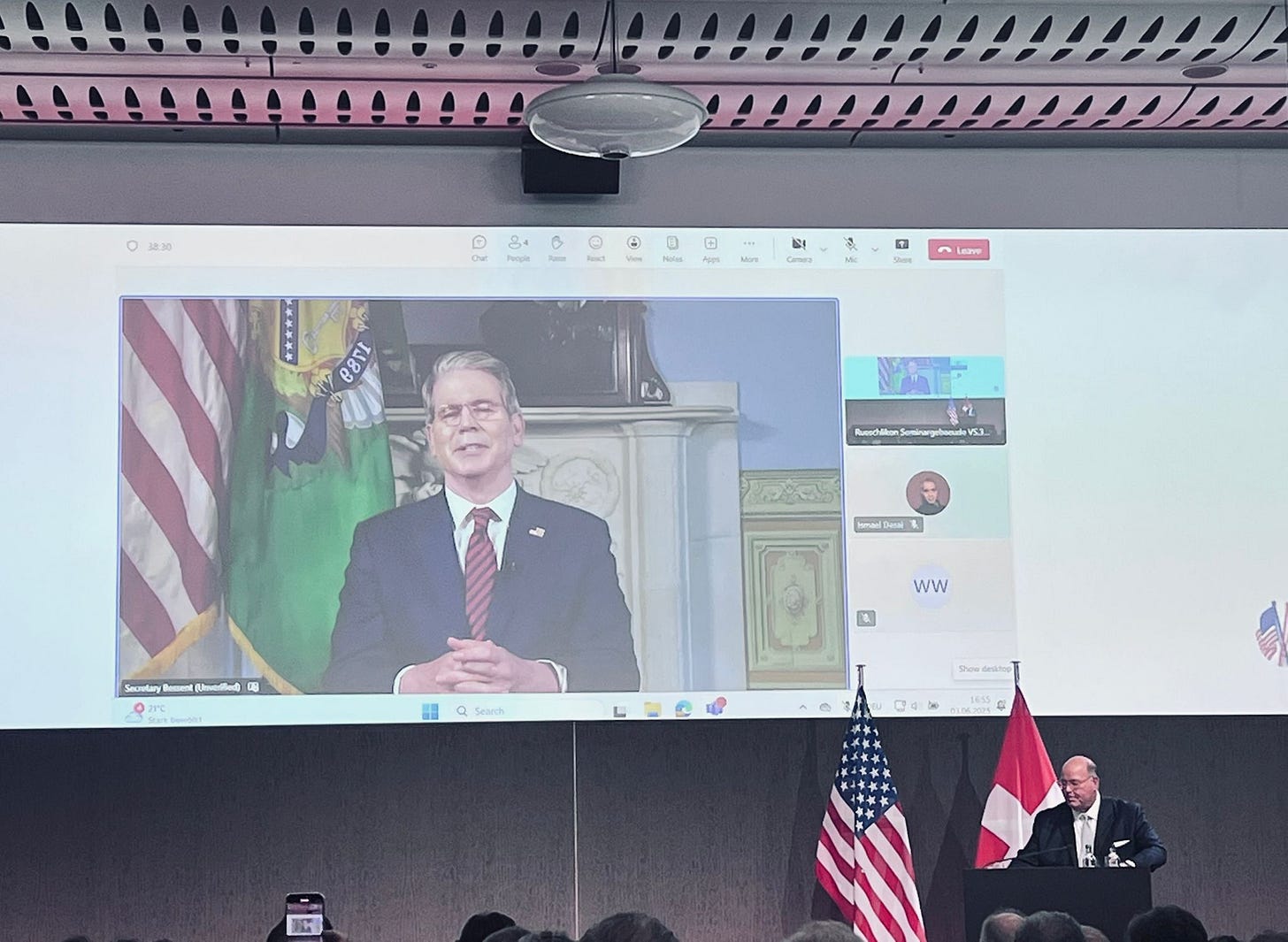

Top of the list

Switzerland and the United States are different in many ways - size being one of them.

But the two countries are actually not so terribly far apart - thanks in no small part to the American-Swiss Foundation, an 80-year old organization dedicated to fostering business and cultural ties at the highest levels.

This week that relationship came into special focus.

At its 2nd annual Leadership Summit in Rüschlikon, the ASF welcomed US Treasury Secretary Scott Bessent with a video message and Q&A from Washington D.C.

Besides promoting the economic agenda of the Trump Administration - and his strategic vision for re-balancing trade in the US - Bessent heaped praise on Switzerland.

He wasn’t the only one.

Former US Ambassador Ed McMullen - a long-time fan of the country - praised the Swiss as well. As a frequent visitor to the country with longstanding ties to the business community, McMullen has a personal admiration for the Swiss.

Their praise stems from what they admire (and desire) in Switzerland:

Fierce independence - Sovereignty is a big theme with the Republican administration - as opposed to multi-lateralism. The fact that Switzerland is not part of the EU makes it a shining example to Trump.

Direct democracy - While some people misinterpret direct democracy as “populism” - there is not doubt that Republicans like the idea of “people having their say”.

High-tech manufacturing - Of all the qualities that Switzerland possesses, its strong, home-grown and highly valuable manufacturing industry, with highly-skilled workers, is perhaps what Trump longs for most.

The case for an American-Swiss deal

As with any negotiations, both sides have their perspective.

Bessent and McMullen emphasized the great area of common ground. Swiss President Karin Keller-Sutter - speaking in a pre-recorded message - was also positive, but still subtly combative.

The biggest star of the discussion at the Swiss Re Centre for Global Dialogue was State Secretary for Economic Affairs Helene Budliger.

On stage to discuss the ongoing negotiations in a conversation moderated by Bloomberg’s Annmarie Hordern - Budliger played nice, but made a strong case for Switzerland’s position.

McMullen (and earlier) Bessent praised her for being a tough, hard-nosed negotiator, exactly the type of person to win President Trump’s respect.

All involved agreed that a deal should be done - and McMullen hinted (both on-stage and in the NZZ later) that no other country is in such a good position to get a deal done by 9 July.

Will it be worth it?

A few statistics about trade between the US and Switzerland (as highlighted by multiple speakers at the Summit:

$185 billion - total trade volume of goods and services as of 2023

$352 billion - Total foreign direct investment in the US by Swiss companies, ranking 6th out of all countries.

$55.6 billion - Total services exported to Switzerland in 2023, making Switzerland the 4th largest market for US services.

When it comes right down to it - the US and Switzerland have a lot to win…together.

Clean up job

Ekaterina Ossipova, a key figure at LGT Bank known for attracting wealthy Russian clients from HSBC and Credit Suisse, has abruptly left the bank.

Her departure coincides with LGT's intensified scrutiny over its Russian clientele, leading to the termination of several billion in Russian-linked private banking assets.

A former relationship manager at Credit Suisse, Ossipova rose to the rank of Managing Director at LGT where she worked for more than 12 years.

At the same time, she ran a concierge travel booking agency for UHNWIs called Pillow and Pepper.

Getting its act together?

The departure of such a “rainmaker” does not seem to be an isolated event.

Ossipova's exit follows the recent dismissal of LGT's risk chief, Anna de Veer, suggesting a significant internal restructuring in response to regulatory pressures and reputational concerns.

Speculation has arisen that new LGT Switzerland boss Anke Bridge is tasked with bringing the “princely bank” into line.

Russian assets are a particularly thorny topic.

In July 2024, LGT (which is - of course - owned by Liechtenstein's royal family), decided to terminate relationships with Russian clients residing in Europe who maintain business ties to Russia. This move affects approximately CHF 4 billion in assets.

The decision aligns with increased pressure from Swiss regulators and U.S. sanctions policies, prompting banks to sever connections with clients linked to Russia.

A real enforcer?

The former CS banker took over a year and a half ago and has already made waves.

LGT quickly got a new Chief Risk Officer with Inka Hilgenstock, a German who also hails from Credit Suisse.

Naturally, this has caused cries of “favouritism.”

According to an LGT spokesperson, the COO position was internally advertised, and the selection was based on professional qualifications and personality.

However, sources suggest that Bridge created a new role specifically to bring Hilgenstock into LGT, a position that did not exist before.

A Chart is Worth…

Private banking in Switzerland is on a tear - with new money and new value - according to PwC.

(See The Bonus below).

The Bonus

🪙 Privately rich - A new PwC report highlights the rapid rise in assets under management among Swiss and Liechtenstein private banks, now over 3 trillion CHF in total. (Link)

📉Fixed and falling - The rate of fixed rate mortgages in Switzerland is tanking, again - with short and medium term loans now falling the fastest. (Link)

👍🏻Loving Lucerne debt - Economists at Zürcher Kantonalbank have moved the Canton of Lucerne to the highest debt rating (AAA) in its latests assessment. (Link)