Dear Insider,

The events of the last few days have been dramatic.

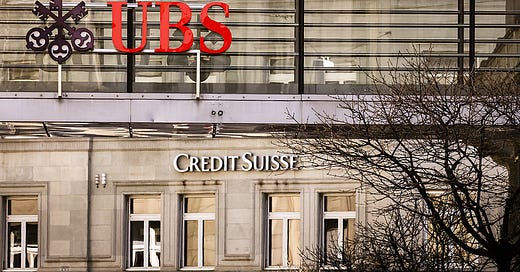

Credit Suisse - one of Switzerland’s oldest and most respected banks - agreed to be taken over by its arch-rival UBS in a deal brokered by the Swiss government in coordination with the Swiss National Bank.

The catalyst was clear - to prevent financial market contagion from spreading.

The result is less clear.

🔍Behind the Scenes:

A brief rundown of the events that led up to the Sunday evening announcement of UBS’s takeover of Credit Suisse.

Turmoil and support

On Wednesday, 15 March - Credit Suisse experienced a rapid decline in market value. Over the course of the day, CS shares dropped as much as 30%. Commentators began wondering how the Swiss giant could survive.

Breathing room

In the late hours of the day, international media reported that Credit Suisse had turned to the Swiss National Bank and regulator FINMA for support. A statement of regulatory compliance convinced no one. A further announcement that CS had made use of over CHF 50bn in extra liquidity from the SNB also did nothing to calm nerves.

The flood

Over the course of Wed, Thurs and Fri - client deposit outflows reached levels of nearly CHF 10bn per day. The sustained run turned out to be the nail in the coffin of Credit Suisse.

Sharks in the water

Chairman Axel Lehmann and other commentators made much of the media’s influence on the CS share price - and client confidence. After a social media storm in October 2022, the focused reporting of The Financial Times and Bloomberg, along with Reuters helped shed (unwelcome) light on the precarious position of Credit Suisse.

Weekend war-games

Heading into the weekend, it was widely reported that a solution needed to be found for the ailing bank. Both international media and Swiss media outlets reported that FINMA, the SNB and Federal Councillors were meeting around the clock to find a solution.

Playing the game

Saturday, 18 March, brought more drama. Mid-day the media reported that negotiations were ongoing. By Sunday AM, it was clear that a UBS takeover was in the cards. But an initial (low-ball) CHF 1bn offer was rejected by Credit Suisse. Following rumors of nationalization of the big bank, an increased offer from UBS was tendered.

Head-honcho ping-pong

Various reports leaked to both international and local media suggesting that UBS CEO Ralph Hammers would be replaced by a “caretaker” executive, former UBS CEO Sergio Ermotti - who would be charged with leading the new, super-bank. This later proved to be a red herring.

The place where it happened

The bulk of discussions regarding the Credit Suisse crisis took place in the Bernerhof Hotel in Bern - the home of the Swiss Department of Finance.

The bitter end

Shortly before 18:00 on Sunday, 19 March , it was reported that a deal had been reached. The Swiss Federal Council called a press conference for 19:30. At around 19:00, press releases from Credit Suisse and UBS were issued. At the press conference, SNB President Thomas Jordan, Finance Minister Karin Keller-Sutter - as well as UBS Chairman Colm Kelleher and Credit Suisse Chairman Axel Lehmann spelled out the tough details of the plan.

Enjoying The Swiss Insider? Share with a friend, a colleague - or someone who should get smarter.

🏆Winners and Losers:

There were some big winners - and more than one loser - in the entire drama.

Winners:

UBS - Obviously, the last big bank standing in Switzerland had something to gain from the takeover action. A heavily discounted, international bank with top talent and trillions in assets…what isn’t to like?

Cantonal banks - Switzerland’s second tier of banks, with a heavily domestic focus - are set to benefit greatly from Credit Suisse’s demise. UBS clearly focuses on wealth management, while CS had a strong presence for small businesses. Now Zürcher Kantonalbank and others will step in to fill the void.

SVP - The right-wing People’s Party, with patriarch Christoph Blocher in the background, will no doubt win votes in the 2023 parliamentary elections. A semi state-sponsored “bailout” of Credit Suisse (with its filthy rich management members) will drive a strong turnout from the rank-and-file of the populist party.

Losers

UBS - Even with a sweet deal, UBS stands to lose as much as it gains. Already on Monday morning after the announced deal, its share price fell significantly. The potential for future losses is still great.

FDP - If the Swiss People’s Party (SVP) is set to benefit from the chaos, the more liberal FDP party will probably be hit by the situation. Karin Keller-Sutter - while strong and competent - will have to take it on the chin for organizing the UBS sale. The socialists from SP will fire from the left - with both sides crying foul about a seemingly unfair outcome for “the common man.”

FINMA and Ueli Maurer - The Swiss Financial Market Authority FINMA was asleep at the wheel - as was former Finance Minister Ueli Maurer (SVP) during the time when it might still have been possible to save Credit Suisse. The controversial decison to wipe out CoCo bond holders at Credit Suisse will also erode confidence in FINMA.

Brand Switzerland - There is no way to cut the cake - the Swiss financial services brand will suffer greatly from the fall of so great a name as Credit Suisse.

📻Stay tuned…

The situation is far from over and continues to develop. Stay tuned for the regular Saturday edition of The Swiss Insider - complete with a deeper look at unexpected consequences from the UBS-Credit Suisse tie-up.